Banking sector is core of Economy. Another crisis in India banking system. After the PMC Bank (Punjab And Maharashtra Cooperation Bank), Yes Bank is on the verge of collapsing. This lead to many unanswered questions i.e.

1) Why did

such crises happen?

2) What would

be its affect on the common man?

3) How will it affect the economy of India?

4) How can

Yes Bank be revived from this crisis?

Today we will be do its in-depth analysis which all of need to know..

PMC BANK VS YES-BANK

The first thing we need to understand is the crisis faced by Yes Bank is

much bigger than the PMC Bank Crisis. In comparison to PMC Bank which is a cooperative bank, Yes Bank bigger in business size i.e is 4th largest private bank of India. There are many big

companies which depend on these private banks. In the case of Yes-Bank there

are more than 20 companies which depended on Yes Bank as it was their only

banking partner for UPI (Unified payment’s Interface) such as Phone-Pe, Flipkart,

Swiggy, Redbus etc. In fact, the 35% of UPI transactions which take place in

India are done through YES-BANK. The amount of money deposited in PMC Bank was

₹11,000 Crores whereas in Yes bank deposits were over ₹2,00,000 Crores. PMC

Bank has 800+ employees whereas yes bank has over 18,000 + employees. If such

bank shuts down, then it will surely affect the depositor’s but will also lead

to a massive collateral damage in our banking system.

To understand the crisis, we first need to know the array which led the

fall of yes-bank

The Rise and the fall of Yes Bank

The story starts from

2004 when Mr. Rana Kapoor and Mr. Ashok Kapoor started yes bank. In the 26/11

attack Mr. Ashok Kapoor was killed and a war began between Mr. Rana Kapoor and

wife of Ashok Kapoor i.e. Mrs. Madhu Kapoor, about handling the appointment

of the board of directors in yes bank. The main point is that Rana Kapoor is

alleged in the way he was running the bank. He was aggressively giving loans to

companies that had very less chances that they could repay their loans. In 2015

a global financial services company named UBS pointed out that the secret of

extreme growth of yes bank is that they are giving hefty loans to potentially

stressed companies that means there is a very high risk that they will default in repayment of loan installments.

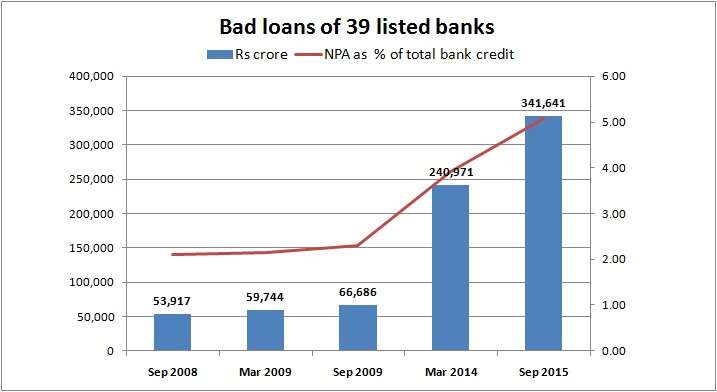

These NPA’s increased potentially. In 2017 The Reserve Bank of

India noticed that NPA’s are increasing and Yes bank is hiding their original

NPA’s through manipulation. This data manipulation shows NPA's on lesser by 5 times as compared to original figures.

In September 2018 RBI ordered that Mr. Rana Kapoor has to leave his CEO

position. In November 2018, 2 Independent directors resigned from yes bank over

corruption charges. The ratings of the bank kept on declining and a reputed

rating’s firm "MOODY" downgraded the rating of "Yes Bank" from stable to negative. In

march 2019 Mr. Ravneet Gill became the CEO of yes bank but by that time it was

too late and in April 2019 yes bank declared its first quarter loss of ₹ 1,507

Crores and their stock felt over 30% that day and their NPL ratio reached

around 8%. (We Will talk about NPL ratio later). In November 2019 Mr Rana

Kapoor sold all his shares that were valued over ₹ 142 Crores and exited the

company. Finally, on 5th march 2020 RBI took the control of yes bank

in its hand and declared a moratorium and restricted the withdrawal limit to ₹

50,000 except any financial emergency. There was news that SBI would probably

buy some shares of yes bank and later Mr. Rana Kapoor was arrested over money

laundering charges.

So, this was the complete background of the story so now let us try to

search for the answers we raised above.

1) Why

do depositors suffer?

To answer the question, we first need to

understand the mechanism in which the bank works. When depositors deposit their

money into the bank it is not always kept in bank but is distributed in form of

loans. Bank earns interest from loans and advances and gives to depositors on their deposits. Difference between interest earned and paid is the profit to the bank. If all the depositors

come together to withdraw their money then bank will be unable to give them

their money because only 4% of money is kept in liquid form, whereas 96% is distributed as

loans. This is called the Cash Reserve Ratio which is minimum of 4% according

to RBI guidelines.

In case of Yes Bank the loan money wasn’t

received back and liquid ratio fell below 4%. In created crisis in repayment. Due to crisis is payment everyone got panic and ran to withdraw their money which

lead to a situation called bank run. That’s why RBI imposes a

withdrawal limit since available cash was not sufficient.

2)

The

root cause and who took the loans?

The companies which defaulted against the loans

were Café Coffee Day, DHFL, Reliance Anil Dhirubhai Ambani group, Essel group

(Zee media entertainment).

The Politics

The Opposition has pointed out that people who

have defaulted loans are close friends of Prime Minister Shri Narendra Modi

such as Anil Ambani, Subhash Chandra etc. whereas as BJP is straight forwardly

alleging that the mess is created due to UPA GOVERNMENT.

But according to statistics most of the loans

were given after 2014:

So, the question arises that why were so much

loans given after 2017 despite of RBI monitoring and knowing the fact that Yes Bank is in loss and a surprising fact is that a month earlier the restriction

was imposed ADANI COMPANY stopped using

Yes Bank services and just a day before the withdrawal limit was set a Gujrat

firm (Vadodara smart city development company) withdrew ₹ 265 Crores from yes

bank so it is a natural question that did these special people who are very

close to government already knew that the government is going to do something

i.e. they were prior informed by the internal sources or just is was a coincidence ?

3) The

effect on Indian Economy.

The problems of NPA has increased so much in

the last few years in India, that no other country than ours is suffering from

this. The NPL ratio which is the NON - PERFORMING LOAN RATIO is the number

of bad loans / total number of loans. In India last year it reached 11% which

is the world’s worst NPL ratio ever.

But subsequently this year we came at the second last position before ITALY.

The major economies such as USA, UK have an NPL ratio less than 2% whereas

only Yes Bank has an NPL over 8%. The

recovery rate of India is just 30 % which is not a satisfying figure.

These figures reduce investors confidence in economy, and they prefer to invest in safer countries. This is not good sign for ecoomy.

4) Is

Your Money Safe?

In today’s scenario if your money is kept in Yes Bank then your money is 80% safe because in no case the government can

afford to get this bank failed, because it is again a very big bank with a lot of

hefty deposits. If it fails then the public will loose confidence and the

banking system will collapse since people will believe that any bank can fail

irrespective of its track record. So, it takes us to the next question that how

the government will save it.

5)

How

to save the bank?

The government will try to bailout this bank

and it has started doing so. Government has ordered SBI to buy this bank and

SBI has acquired 49% stake of the bank at ₹ 2,450 Crore. But the money which

SBI is using is the money of the taxpayers which is being used to bailout a

bank and it is a debatable question that

1)

Is

it correct to use the money of the taxpayers to save private banks?

2)

How

many times the government will order SBI to save the private banks?

3)

Where

is the capital to acquire banks is coming from?

One intention

is clear that government is trying to arrange money by selling out PSU’s as

some months earlier government showed interest selling it’s 52.98 % stake in

BPCL. So, SBI will try to build up confidence in people to remain with Yes Bank which will further lead to increase in share price of Yes Bank and

once again investors would come and invest in it and Yes Bank will revive

again.

So, let’s see what

happens next and this was the complete case study on yes bank. Do leave your

comments and tell us how did you like our unbiased review.

Credits

1)

The

Print

0 Comments

Please do not enter any spam links in the box